All Categories

Featured

Table of Contents

Note, nevertheless, that this does not state anything regarding adjusting for inflation. On the plus side, also if you presume your choice would certainly be to buy the securities market for those seven years, which you would certainly get a 10 percent yearly return (which is much from specific, specifically in the coming years), this $8208 a year would be even more than 4 percent of the resulting nominal stock worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with 4 repayment choices. Politeness Charles Schwab. The monthly payout here is highest for the "joint-life-only" alternative, at $1258 (164 percent higher than with the prompt annuity). The "joint-life-with-cash-refund" option pays out only $7/month much less, and warranties at the very least $100,000 will certainly be paid out.

The means you get the annuity will establish the answer to that inquiry. If you purchase an annuity with pre-tax dollars, your premium decreases your taxed revenue for that year. According to , buying an annuity inside a Roth plan results in tax-free payments.

Where can I buy affordable Annuities?

The advisor's primary step was to develop a comprehensive monetary strategy for you, and after that discuss (a) how the proposed annuity suits your total plan, (b) what alternatives s/he thought about, and (c) just how such choices would certainly or would not have actually led to lower or higher payment for the advisor, and (d) why the annuity is the premium choice for you. - Retirement annuities

Naturally, an advisor might attempt pressing annuities even if they're not the very best fit for your scenario and objectives. The factor can be as benign as it is the only item they offer, so they drop victim to the proverbial, "If all you have in your toolbox is a hammer, pretty soon everything starts looking like a nail." While the expert in this circumstance may not be unethical, it enhances the threat that an annuity is a poor option for you.

How do I get started with an Guaranteed Return Annuities?

:max_bytes(150000):strip_icc()/Immediate-variable-annuity.asp-final-c62d88ef3f7a4b688c0303ef04e1fbce.png)

Given that annuities usually pay the agent selling them much higher commissions than what s/he would certainly obtain for investing your money in shared funds - Income protection annuities, allow alone the absolutely no compensations s/he would certainly obtain if you spend in no-load mutual funds, there is a huge motivation for representatives to push annuities, and the more difficult the much better ()

A dishonest advisor suggests rolling that amount right into new "better" funds that just occur to bring a 4 percent sales load. Accept this, and the advisor pockets $20,000 of your $500,000, and the funds aren't most likely to carry out better (unless you picked a lot more poorly to begin with). In the exact same instance, the consultant can guide you to acquire a complex annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The advisor hasn't figured out how annuity repayments will be taxed. The expert hasn't disclosed his/her compensation and/or the charges you'll be charged and/or hasn't shown you the influence of those on your ultimate payments, and/or the compensation and/or fees are unacceptably high.

Your family members background and current wellness factor to a lower-than-average life expectations (Deferred annuities). Existing rates of interest, and thus forecasted repayments, are traditionally low. Also if an annuity is ideal for you, do your due diligence in comparing annuities marketed by brokers vs. no-load ones marketed by the releasing business. The latter might require you to do even more of your own research study, or make use of a fee-based economic advisor that may receive settlement for sending you to the annuity issuer, yet might not be paid a greater payment than for other investment choices.

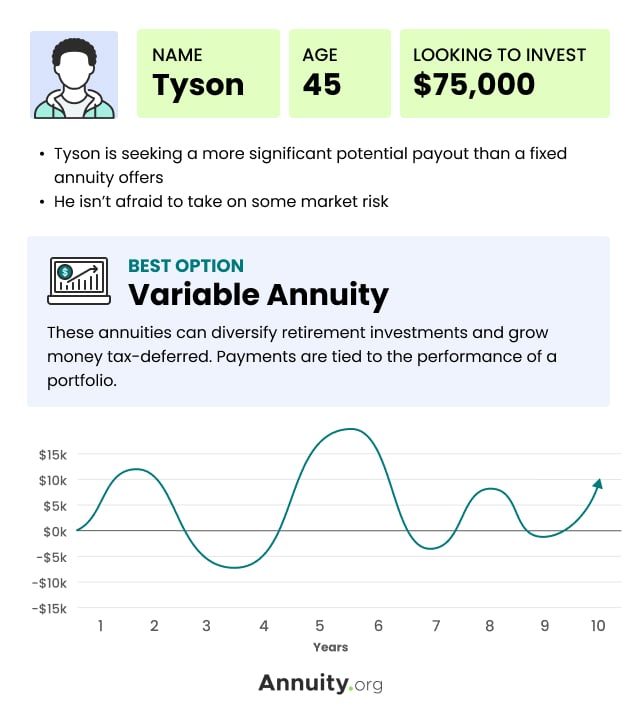

Variable Annuities

The stream of month-to-month payments from Social Protection is comparable to those of a postponed annuity. Considering that annuities are volunteer, the individuals buying them typically self-select as having a longer-than-average life span.

Social Safety and security benefits are fully indexed to the CPI, while annuities either have no inflation protection or at a lot of supply a set percentage yearly rise that might or might not make up for rising cost of living in full. This kind of biker, just like anything else that boosts the insurance company's risk, requires you to pay more for the annuity, or approve reduced settlements.

Where can I buy affordable Annuity Interest Rates?

Please note: This post is meant for informational purposes only, and must not be considered financial guidance. You must get in touch with a monetary professional prior to making any kind of significant financial choices. My occupation has actually had several unpredictable spins and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research placement in experimental cosmic-ray physics (including a couple of visits to Antarctica), a short job at a little engineering services business supporting NASA, followed by starting my very own small consulting practice supporting NASA tasks and programs.

Considering that annuities are intended for retirement, taxes and penalties may apply. Principal Security of Fixed Annuities. Never lose principal because of market performance as taken care of annuities are not spent in the market. Also throughout market declines, your money will certainly not be influenced and you will certainly not lose cash. Diverse Financial Investment Options.

Immediate annuities. Utilized by those who desire reputable revenue right away (or within one year of acquisition). With it, you can customize revenue to fit your needs and create earnings that lasts permanently. Deferred annuities: For those that desire to grow their cash over time, but want to delay access to the cash until retirement years.

Why is an Fixed Indexed Annuities important for my financial security?

Variable annuities: Supplies greater potential for growth by investing your money in financial investment choices you pick and the ability to rebalance your portfolio based on your choices and in a manner that lines up with altering financial objectives. With taken care of annuities, the company spends the funds and offers a passion rate to the customer.

:max_bytes(150000):strip_icc()/present-value-annuity.asp-Final-7d2ae860c2b044069d77d5e626c5a6f3-72cf6d2c9f9041608b7cd343cbc3f2f4.png)

When a death insurance claim happens with an annuity, it is very important to have a called recipient in the agreement. Different choices exist for annuity survivor benefit, relying on the contract and insurance company. Choosing a refund or "duration certain" choice in your annuity provides a fatality benefit if you die early.

How do I receive payments from an Annuity Riders?

Naming a recipient aside from the estate can assist this procedure go more smoothly, and can assist guarantee that the earnings most likely to whoever the specific wanted the cash to go to as opposed to experiencing probate. When present, a death advantage is automatically included with your agreement. Depending on the kind of annuity you buy, you may have the ability to include enhanced fatality benefits and attributes, however there could be additional expenses or charges related to these attachments.

Table of Contents

Latest Posts

Understanding Fixed Annuity Or Variable Annuity A Closer Look at Variable Vs Fixed Annuities Breaking Down the Basics of Investment Plans Pros and Cons of Indexed Annuity Vs Fixed Annuity Why Fixed In

Highlighting Fixed Vs Variable Annuities Everything You Need to Know About Indexed Annuity Vs Fixed Annuity What Is Variable Annuity Vs Fixed Annuity? Features of Variable Annuity Vs Fixed Indexed Ann

Breaking Down Fixed Vs Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Indexed Annuity Vs Market-variable Annuity Why Variabl

More

Latest Posts